Due to copyright reports and some issues affecting our previous contact channels, we’ve officially moved to new accounts to ensure smooth and reliable communication with everyone.

Please update your records and contact us only through the new official links below:

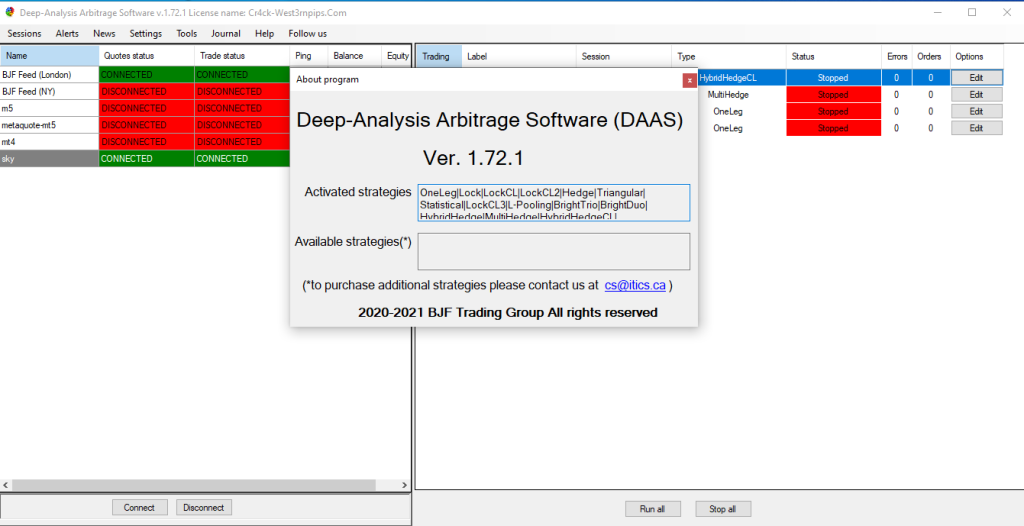

old site : crack-westernpips.com

old telegram id : @drm**avi2 this one taken by scammer don’t send msg to that and report this one

We appreciate your understanding and continued support.

If you’ve recently tried reaching out through our old Telegram or site and didn’t get a response, please contact us again via the new address above.

Thank you for staying connected with us — we’re back, stronger and more secure than before. 💪

—Ahmad musavi

Microstructure data = the lowest level of trading information:

In high-frequency trading (HFT), your “edge” comes from reacting to these microsecond-level dynamics faster and smarter than competitors.

So the challenge isn’t just prediction — it’s prediction under latency + noise + regime change.

Short answer:

✅ Yes — ML can help with pattern detection, classification, microstructure understanding,

❌ But not every ML method fits real HFT constraints (latency, stability, slippage).

You don’t want a 100-million-parameter Transformer doing inference while your competitor executes in 200 µs.

So: Use ML carefully, focusing on fast, robust, interpretable models.

Here’s what top proprietary firms and academic papers use effectively:

| Rank | Model | Why It Works |

|---|---|---|

| 🥇 Temporal Convolutional Networks (TCN) | Captures short-term temporal dependencies; faster than LSTMs; can process dense tick data. | Predict short-term price direction / order imbalance |

| 🥈 LSTM / GRU (lightweight) | Sequential pattern modeling; works well if trained on event-based data. | Predict next-tick price move, trade volume, spread change |

| 🥉 1D CNNs on limit order book snapshots | Captures spatial structure (price levels × depth). Simple, fast. | Predict mid-price movement (↑/↓/→) |

| 4️⃣ Graph Neural Networks (GNN) | Model relationships between different order levels / instruments. | Cross-asset microstructure dependencies |

| 5️⃣ Reinforcement Learning (RL) | Learns execution strategy rather than price direction. | Optimal order placement, market-making, latency arbitrage |

| 6️⃣ Hybrid (CNN + LSTM + Attention) | Combines spatial + temporal + selective focus. | Multi-asset HFT systems or deep limit order book prediction |

A few concrete examples (from real HFT/LOB papers):

| Model | Dataset | Result |

|---|---|---|

| DeepLOB (Zhang et al., 2018) | LOBSTER dataset | CNN+LSTM+Inception blocks, great for short-term mid-price movement prediction. |

| DeepLOB-ATTN (2021) | Extended DeepLOB with attention | Improved interpretability and stability. |

| TCN-LOB (2020) | Temporal convolutional model for order book | Faster inference, comparable accuracy. |

| RL-Execution (2019–2023) | Simulated microstructure | RL agent optimizing trade execution cost; used by market-making desks. |

A practical high-frequency ML stack often looks like this:

Convert LOB/tick data to engineered features:

You should ignore or limit ML if:

In these cases, rule-based or linear models outperform deep ones simply because they’re faster and easier to maintain.

| Situation | Recommended Approach |

|---|---|

| You have millisecond data and want to detect order flow pressure | → Use CNN/TCN (e.g., DeepLOB-like) |

| You want to optimize execution strategy (not direction) | → Use Reinforcement Learning (PPO/DDPG) |

| You’re competing in ultra-HFT (microsecond) | → Skip ML; use FPGA + hard-coded logic |

| You’re doing short-term trading (seconds to minutes) | → Hybrid: ML signal + rule-based execution |

“Now we were sending out orders before the data packet arrived.”

Korean trading. Fun and games with Japanese infrastructure. The Toronto – New Jersey interlisted arb. How not to negotiate multi-million dollar deals. Reverse engineering the ASX. Building the world’s fastest (at the time) network switch and matching engine. Killing canaries. The ATS that wasn’t. Lots of reading fun to be had by all.

I started my HFT career at one of the larger American trading firms as a C++ jockey. On my first day, I was greeted by full panes of glass boasting glorious Sydney Harbour views which were modestly obscured by a hand-scrawled “< 2ms” on that glass. This was the main goal for the dozen of us in IT. That wasn’t my remit at the start though. First things first…

Continue reading HFT paper

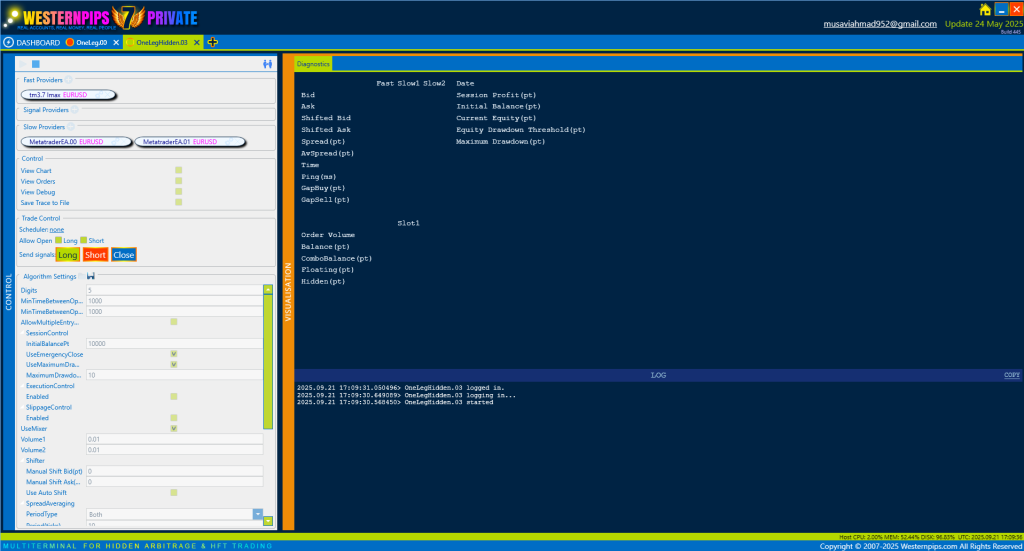

we change feed server to this one : 103.151.248.67